Peter Schiff, an outspoken financial commentator and economist, is well-known for his sharp takes on economic policy, the gold market, and global trade. Through his posts on X, Schiff often critiques U.S. fiscal strategies, inflation risks, and the role of government in economic matters. The following tweets showcase some of his most provocative commentary, offering insights—and raising eyebrows—about current global and domestic economic trends.

1. America’s Economic Philosophy

Source: https://x.com/PeterSchiff/status/1280257955787661315

“America was founded by rugged individuals who created government to secure their rights and leave them alone. Americans today want government to violate other people’s rights, steal their stuff, and give it to them. The home of the free has become the land of the freeloader.”

Peter Schiff’s 2020 tweet reflects his libertarian stance rooted in the Austrian School of economics, advocating minimal government intervention. He contrasts modern entitlement attitudes with the Founding Fathers’ vision of securing rights—not redistributing wealth. The tweet sparked debate, with critics pointing to America’s historical contradictions and calling out Schiff’s own tax avoidance strategies, revealing tensions between his ideals and actions.

2. China’s Impact on Consumer Goods

Source: https://x.com/PeterSchiff/status/1919902524414284054

“I keep hearing that China is our enemy. Those bastards have been bombing us with consumer electronics, furniture, appliances, bedding, lighting, toys, sports equipment, clothing, footwear, auto parts, jewelry, beauty products, stationery, pet supplies, etc. It’s been brutal.”

Peter Schiff uses sarcasm to highlight America’s economic dependence on Chinese imports by framing consumer goods as a form of “attack.” His tweet critiques the idea of China as an enemy, instead drawing attention to the U.S.’s reliance on low-cost goods that fuel domestic consumption. This aligns with Schiff’s broader Austrian economics stance against overconsumption and debt. While his tone downplays geopolitical tensions, it indirectly critiques the U.S.–China trade imbalance, which he views as unsustainable.

3. Schiff Calls Out Treasury Secretary’s Tariff Dodge

Source: https://x.com/PeterSchiff/status/1919884142730154311

‘‘Our Treasury Secretary Scott Bessent is a very smart man. He’s not the blubbering idiot shown in this clip. The reason he can’t answer the simple question “who pays tariffs” is because he knows the answer. He is stammering because he is struggling to formulate a BS explanation.’’

Peter Schiff criticizes Treasury Secretary Scott Bessent’s inability to answer who pays tariffs, suggesting he avoids the truth to dodge political fallout. Schiff argues importers pay and pass costs to consumers—an economic consensus. He defends Bessent’s intelligence but questions his public performance under pressure and references his hedge fund’s collapse as a credibility issue.

4. Channel 9 Defamation Scandal

Source: https://x.com/PeterSchiff/status/1919792523838435552

“Channel 9 paid a witness $700k not to expose @Ageinvestigates as a liar. Channel 9 is completely corrupt. My winning defamation lawsuit against McKenzie proved that 9 spends millions to cover for McKenzie’s lies. They know their star reporter is a fraud.”

Peter Schiff claims Channel 9 paid $700K to silence a witness in his defamation case, accusing the network of protecting false reporting. His post references a legal victory tied to misleading coverage of Euro Pacific Bank and criticizes Channel 9’s ethical standards, linking it to a wider pattern of misconduct documented in recent media investigations.

5. U.S. Dollar and Gold’s Role

Source: https://x.com/PeterSchiff/status/1919806595795390514

“The U.S. dollar is about to free fall and gold will soar to heights few can imagine. The only way to end America’s massive trade imbalance is to end the dollar’s role as the global reserve currency. Gold is the only monetary asset that can replace the dollar. Buy $EPGIX today.”

Peter Schiff warns the U.S. dollar is on the verge of collapse due to trade deficits and global instability, promoting gold—and his own gold fund—as the only reliable monetary alternative. While citing rising central bank gold reserves, he rejects cryptocurrencies like Bitcoin, which he calls fraudulent, despite their growing global adoption.

6. U.S. Trade Deficit

Source: https://x.com/PeterSchiff/status/1919780978253271492

“The U.S. trade deficit widened to a record high $140.5 billion in March, the fourth monthly increase in the past five months. According to Trump, the U.S. was losing $5 billion per day on trade under Biden. Based on his own criteria, the U.S. is losing even more on trade now.”

Peter Schiff highlights a record $140.5B U.S. trade deficit in March 2025, challenging Trump’s claims of trade success and exposing a gap between political rhetoric and economic data. He notes that the deficit now exceeds Trump’s own $5B-per-day benchmark under Biden, linking the surge to pre-tariff stockpiling by businesses.

7. Manufacturing and Consumption

Source: https://x.com/PeterSchiff/status/1919758162770416025

“To increase our manufacturing and become less dependent on the rest of the world, Americans must consume less and produce more. But a weaker dollar will only cause us to consume less. Savings won’t rise as our spending won’t go down, just the quantity of goods we actually buy.”

Peter Schiff argues a weaker U.S. dollar will reduce purchasing power without increasing savings, urging less consumption and more production. He critiques policies that use devaluation to stimulate manufacturing, warning of deeper issues like overconsumption, low GDP growth, and middle-class stagnation.

8. Schiff Slams Tariffs as RMB Rises

Source: https://x.com/PeterSchiff/status/1919738710976851977

“The Chinese RMB jumped 0.8% overnight, hitting its highest level since Nov. 2024, prior to Liberation Day. Trump promised China would pay our tariffs with a weaker RMB. Instead our tariffs will cost us even more, resulting in Americans consuming less as the Chinese consume more.”

Peter Schiff criticizes Trump’s tariff plan after the Chinese RMB rises 0.8%, undercutting claims that a weaker yuan would offset tariffs. He warns that the stronger RMB increases costs for Americans while potentially fueling more domestic consumption in China, revealing the economic trade-offs behind tariff-driven strategies.

9. Schiff on Debt and Trade Risks

Source: https://x.com/PeterSchiff/status/1919498891600261369

“According to Scott Bessent, when it comes to trade negotiations, the surplus nation always has the most to lose. China risks losing out on under-consuming and buying a bunch of Treasuries & MBS. We risk losing out on living beyond our means and getting China to finance our debts.”

Peter Schiff cites Treasury Secretary Bessent’s view that surplus nations like China risk more in trade talks, while the U.S. relies on debt-driven overconsumption. He critiques U.S. dependence on Chinese financing through Treasuries and MBS, warning this creates long-term vulnerabilities—a position consistent with his Austrian economics stance.

10. Schiff Dismisses Bitcoin as Gold Alternative

Source: https://x.com/PeterSchiff/status/1919486466834432049

“Gold rose over $90 today. That’s a 3% gain from Friday’s close. Over the same time period Bitcoin fell by 3%. How can something that is claimed to be a digital version of gold, trade like the mirror image of gold? Bitcoin may be digital, but it’s got nothing in common with gold.”

Peter Schiff points to gold’s 3% rise and Bitcoin’s 3% drop in one day to dispute claims that Bitcoin is “digital gold.” He argues that such inverse movement proves Bitcoin lacks the stability and store-of-value characteristics of gold. Critics responded by citing long-term performance data and challenging Schiff’s focus on short-term fluctuations.

11. Schiff Criticizes 60 Minutes Emmy Nomination

Source:https://x.com/PeterSchiff/status/1919472520689787072

“60 Minutes was nominated for an Emmy for its ‘Outstanding’ Edited Interview with Kamala Harris. @CharlotteGriev1 won @CitiAustralia’s award for Excellence in Journalism for her work on a defamatory 60 Minutes segment for which she agreed to pay a judgment of 550K Aussie dollars.”

Peter Schiff criticizes 60 Minutes for receiving an Emmy nomination while highlighting journalist Charlotte Grieve’s defamation settlement over a related segment. He questions media credibility and underscores tensions between award recognition and legal accountability in journalism, reinforcing his broader skepticism toward media integrity.

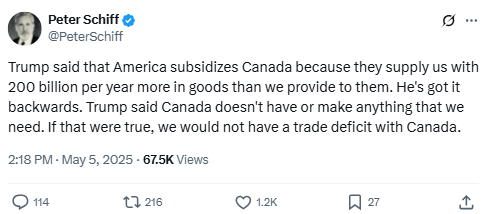

12. Schiff Refutes U.S.–Canada Trade Deficit Claim

Source: https://x.com/PeterSchiff/status/1919350907017318410

“Trump said that America subsidizes Canada because they supply us with 200 billion per year more in goods than we provide to them. He’s got it backwards. Trump said Canada doesn’t have or make anything that we need. If that were true, we would not have a trade deficit with Canada.”

Peter Schiff rebuts Trump’s claim that the U.S. subsidizes Canada via trade, pointing out that a deficit reflects U.S. demand for Canadian goods, not aid. He calls out the contradiction in Trump’s logic and cites actual data showing a much smaller $36B deficit, undercutting the narrative of excessive U.S. economic support.

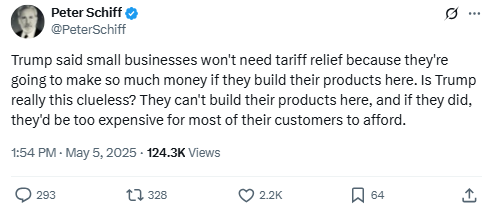

13. Schiff Criticizes Tariff Relief Logic

Source: https://x.com/PeterSchiff/status/1919344882822357221

“Trump said small businesses won’t need tariff relief because they’re going to make so much money if they build their products here. Is Trump really this clueless? They can’t build their products here, and if they did, they’d be too expensive for most of their customers to afford.”

Peter Schiff criticizes Trump’s claim that small businesses can thrive without tariff relief by manufacturing locally. He argues U.S. production costs are too high to support this strategy, making products unaffordable. Schiff’s free-market stance contrasts with Trump’s protectionism, raising concerns about policy impacts on small business viability.

14. Schiff Rejects Bitcoin as Safe-Haven Asset

Source: https://x.com/PeterSchiff/status/1919220809240875457

“Tonight U.S. stock futures and the dollar are both selling off. But once again gold and Bitcoin are going in opposite directions. Gold is acting like a safe haven and rising about 1%. Bitcoin is trading like a risk asset, falling by about 2%. Clearly Bitcoin is not digital gold.”

Peter Schiff highlights a market divergence where gold rises 1% and Bitcoin falls 2%, arguing Bitcoin behaves like a risk asset, not a store of value. Reinforcing his long-standing critique, he contrasts gold’s safe-haven status with Bitcoin’s volatility, challenging claims that Bitcoin is a digital version of gold.

15. Schiff Slams Movie Tariff Plan

Source: https://x.com/PeterSchiff/status/1919210518440472984

“Today Trump announced a 100% tariff on movies produced outside of the United States. But movies aren’t physical goods that come across the border in a way that a tariff can be applied. This would be some new kind of federal excise tax on Americans who watch movies filmed abroad.”

Peter Schiff critiques Trump’s 100% tariff on foreign films, calling it a disguised tax on U.S. viewers. He argues that movies aren’t traditional imports, and such protectionist policies could destabilize global cinema while echoing past economic missteps.

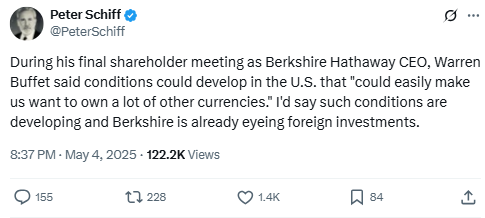

16. Schiff on Buffett’s Currency Shift

Source: https://x.com/PeterSchiff/status/1919083854708584738

“During his final shareholder meeting as Berkshire Hathaway CEO, Warren Buffet said conditions could develop in the U.S. that ‘could easily make us want to own a lot of other currencies.’ I’d say such conditions are developing and Berkshire is already eyeing foreign investments.”

Peter Schiff highlights Warren Buffett’s comments on shifting to foreign currencies, viewing it as a warning about U.S. dollar instability. He suggests Berkshire Hathaway is preparing for de-dollarization amid rising fiscal risks and unsustainable debt levels, aligning with Schiff’s long-held economic concerns.

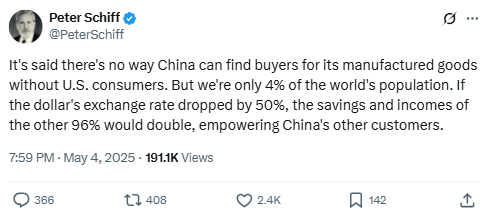

17. Schiff on Dollar Drop & China’s Markets

Source: https://x.com/PeterSchiff/status/1919074432485556433

“It’s said there’s no way China can find buyers for its manufactured goods without U.S. consumers. But we’re only 4% of the world’s population. If the dollar’s exchange rate dropped by 50%, the savings and incomes of the other 96% would double, empowering China’s other customers.”

Peter Schiff argues that a 50% drop in the U.S. dollar would boost global purchasing power, allowing China to rely less on American consumers. He ties this idea to ongoing de-dollarization trends, though critics point to logistical and inflation-related challenges in shifting to new markets.

18. Schiff on Import Tariffs and CPI Impact

Source: https://x.com/PeterSchiff/status/1918392419780903239

“With the de minimis exemption gone, Americans can no longer buy low-cost merchandise directly from Chinese companies. So they’ll have to pay more to buy higher-priced imports or domestic products instead. Even though they pay higher prices, those higher prices won’t show up in the U.S. CPI, unless domestic companies take advantage of the increased demand by raising their already higher prices too.”

Peter Schiff says ending the de minimis exemption will raise consumer costs without showing in CPI data. He critiques U.S. inflation metrics and warns that hidden price hikes may follow, especially if domestic firms exploit rising demand—echoing his Austrian economics stance.

19. Schiff on Stock Gains and Debt Fears

Source: https://x.com/PeterSchiff/status/1918318473937104934

“While the stock market is rising in response to today’s jobs report, Treasuries and the dollar are selling off. This will ultimately weigh heavily on the stock market and the economy, by driving up federal budget deficits, consumer prices, and mortgage and other borrowing costs.”

Peter Schiff warns that despite a stock rally, falling Treasuries and a weakening dollar point to rising deficits and inflation. He views the job report as misleading, arguing that underlying pressures could increase borrowing costs and strain the broader economy.

20. Schiff Calls Out Trump’s Economic Boast

Source: https://x.com/PeterSchiff/status/1918014164628316317

“Trump boasted that the U.S. economy is ‘roaring like never before.’ That would include during his first term, when he claims the U.S. had the best economy in world history. So, in a span of just 100 days, the U.S. economy went from being the worst in history to being the best.”

Peter Schiff mocks Trump’s claim of a record-breaking economy just 100 days into his term, highlighting the inconsistency with earlier statements about economic collapse. Schiff, known for his Austrian School views, links the comment to volatile conditions driven by aggressive trade policies.

21. Schiff on Oil Prices and Recession

Source: https://x.com/PeterSchiff/status/1917925534626988508

“Trump is getting lower oil prices, but it’s not due to ‘drill-baby-drill.’ In fact, with current oil prices, drilling will stop. A better slogan is ‘chill-baby-chill.’ It’s not more supply that is bringing down oil prices, but collapsing demand due to reduced trade and recession.”

Peter Schiff claims low oil prices under Trump result from shrinking demand, not increased drilling. He critiques the “drill-baby-drill” slogan, saying economic slowdown is halting production. His take is backed by data on price pressures and the breakeven costs of shale producers.

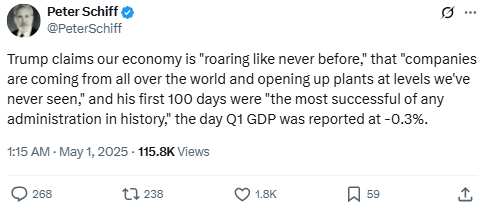

22. Schiff Slams Trump’s Economic Optimism

Source: https://x.com/PeterSchiff/status/1917704511080058964

“Trump claims our economy is ‘roaring like never before,’ that ‘companies are coming from all over the world and opening up plants at levels we’ve never seen,’ and his first 100 days were ‘the most successful of any administration in history,’ the day Q1 GDP was reported at -0.3%.”

Peter Schiff criticizes Trump for celebrating economic success on the same day Q1 GDP showed a 0.3% contraction. He highlights the gap between optimistic political messaging and economic data, pointing to inflation, tariffs, and market losses as signs of real trouble.

23. Retailers to Raise Prices After Tariffs

Source: https://x.com/PeterSchiff/status/1917603541788541045

“U.S. retailers will soon jack up prices on the inventory they stocked up on pre-tariffs. They will need to make higher margins on their existing inventory to make up for the plunge in sales that will result once they must price in the full impact of tariffs on future imports.”

Peter Schiff warns that U.S. retailers will raise prices on pre-tariff goods to offset falling sales and higher import costs under new 145% tariffs. He links this to declining Asian imports and argues that the strategy reflects deeper inflation pressures tied to U.S. economic policy.

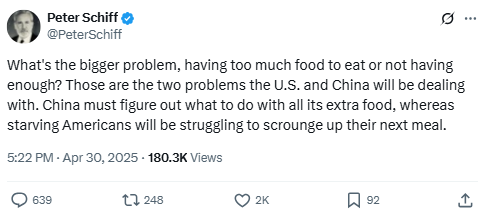

24. Schiff Questions U.S. Food Security Amid China Surplus Claims

Source: https://x.com/PeterSchiff/status/1917585418322616618

“What’s the bigger problem, having too much food to eat or not having enough? Those are the two problems the U.S. and China will be dealing with. China must figure out what to do with all its extra food, whereas starving Americans will be struggling to scrounge up their next meal.”

Peter Schiff contrasts the U.S. and China’s food challenges, claiming America faces hunger while China deals with surplus. He frames this as symbolic of U.S. decline, aligning with his inflation and debt concerns. Critics point to the U.S.’s status as the top global food exporter and cite ongoing trade tensions, especially from retaliatory tariffs impacting American farmers.

25. Navarro’s Tariff Strategy Backfires—Europe Benefits from U.S.-China Trade Tensions

Source: https://x.com/PeterSchiff/status/1917577687477948643

“Peter Navarro warned Europe that as China supplies Americans with fewer low-cost goods, it will be forced to supply those goods to Europeans instead. Now Europeans will be forced to suffer the consequences of more affordable goods, lower interest rates, and rising stock prices.”

Peter Schiff satirically highlights Peter Navarro’s warning that U.S. tariffs on China may shift economic benefits to Europe—cheaper imports, stronger stock markets, and lower interest rates—describing these as ironic burdens. The tweet critiques protectionist U.S. trade strategies and reflects Schiff’s Austrian School stance that consumer price inflation distorts true economic outcomes.

Conclusion

Peter Schiff’s tweets consistently challenge mainstream economic narratives and expose contradictions in political and fiscal strategies. His posts reflect a deep skepticism toward government intervention, inflation data, and trade policies—especially those promoted by recent U.S. administrations. Drawing from Austrian economic principles, Schiff highlights rising debt, currency devaluation risks, and market distortions that he believes are being overlooked or misrepresented. Whether critiquing tariffs, media bias, or cryptocurrency, his commentary encourages a closer examination of how economic decisions impact long-term stability, not just short-term perception.